Boeing set for massive $80 billion order from India following Trump trade deal

Desk Report

| Published: Monday, February 09, 2026

Desk Report

| Published: Monday, February 09, 2026

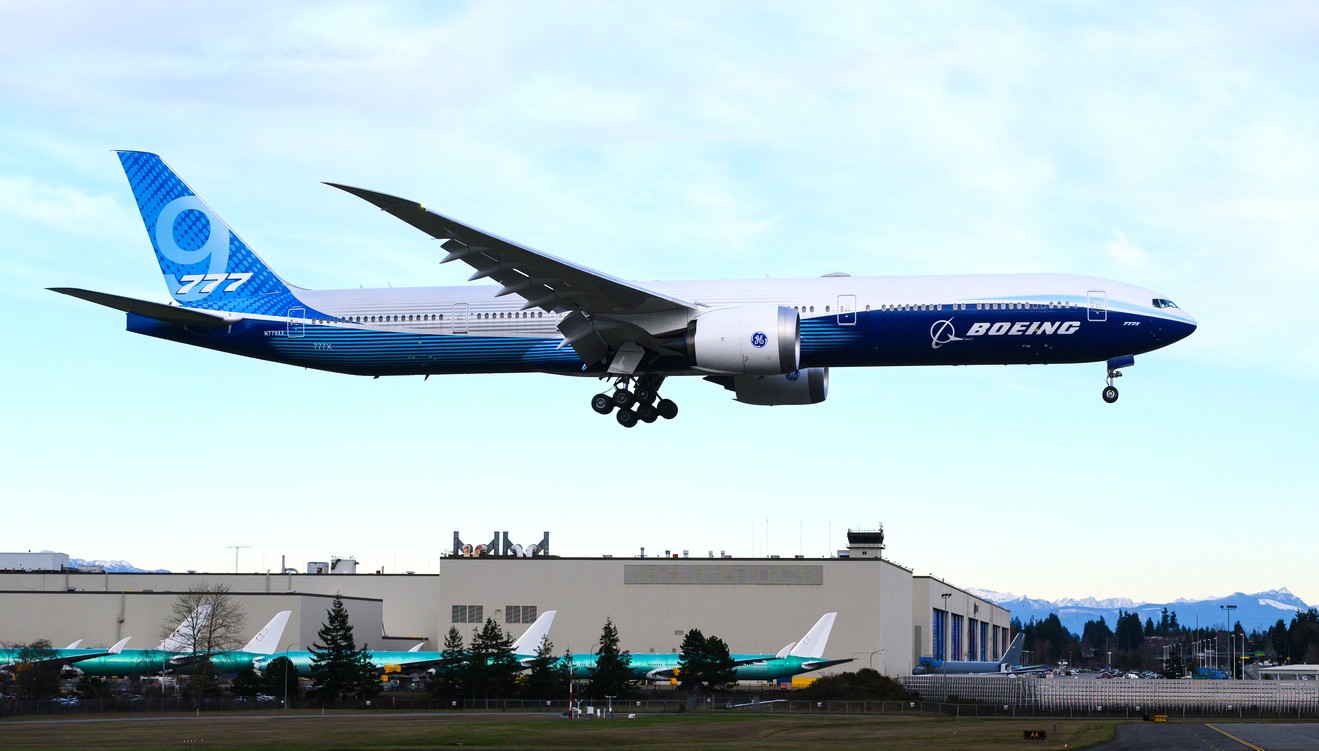

Photo: Shutterstock

The latest rumors suggest that India may soon fulfill one of Boeing's largest single-country orders ever. Following an interim trade framework being approved between the United States and India that was announced this week, Commerce Minister Piyush Goyal said that India is ready to place Boeing aircraft orders worth around $70–80 billion, potentially topping total order valuations of $100 billion when engines and spare parts are included.

These purchases would sit inside a wider pledge to buy roughly $500 billion of US goods over five years, with a formal trade deal currently targeted for March. This headline figure looks more like a policy-backed demand signal than a finalized major contract, but it currently underscores how fast India's airline market is only continuing to scale.

This deal has the potential to offer significant benefits.

This $80 billion figure is best read as an order pipeline that could become multiple airline contracts, not as a massive government purchase order on its own. Goyal has described a mix of Boeing aircraft already ordered and additional jets ready to be ordered, all within a trade deal that officials say could be finalized in March, according to reports published by CNBC.

In practice, these purchasing decisions would sit with carriers, especially Air India and Akasa Air, both of which have already heavily committed to the Boeing 737 MAX family. India's international expansion has also necessitated additional widebody requirements. For instance, Air India announced in January that it has added 40 Boeing 737 MAX aircraft to its Boeing order book. Separately, the framework's tariff cut on US goods could materially improve the economics of importing aircraft, engines, and spare parts into India.

What Financial Considerations Are There To Keep In Mind Here?

First, the sticker number of $70-80 billion here is likely a headline estimate, and real-world pricing will obviously depend on deal specifications, support packages, and substantial discounts from list prices. Second, cash timing is also important to keep in mind. Boeing books most revenue at delivery, so even a signed commitment would not lead to some automatic cash windfall but rather years upon years of staggered payments, including pre-delivery deposits.

It is also necessary to keep in mind that delivery slots and execution risk matter in today's tight supply chain. India's carriers may want aircraft quickly, but Boeing's ability to ramp up output and clear certification and quality bottlenecks will shape timing and margins. It will also matter which airlines actually end up ordering these jets. Legacy carriers may be more interested in larger models, which Boeing builds at higher margins. The same cannot be said for younger low-cost carriers that are more balance-sheet conscious.

On the buyer side, Indian airlines are expanding fast, but they do remain sensitive to financing costs and foreign exchange market moves. Higher rates or a weaker rupee make dollar-denominated jet orders considerably more expensive, pushing carriers toward leases or stretching deliveries. Finally, the trade deal's tariff reset could lower the landed cost of aircraft and parts, improving materially over fleet-growth economics.

A Contract That Would Mean A Lot For Boeing

Let's hypothesize that these rumors actually eventually turn into an $80 billion pipeline from India to Boeing. If that turns out to be the case, that would be huge. It would deepen the airline's share in one of the fastest-growing aviation markets as Indian carriers add capacity, open long-haul routes, and modernize fleets across South Asia and beyond. It would also broaden Boeing's footprint beyond deliveries.

Places like engine management, spare parts management, training, and aftermarket services can lock in decades of recurring revenue and higher-margin support work. The trade framework matters here because it links aircraft buying to a political commitment to expand bilateral commerce, potentially reducing tariff friction and giving airlines and lessors more confidence to place large, multi-year bets.

Equally important, Indian officials and local reporting have suggested that Boeing expects to increase sourcing from India as orders continue to rise, something that supports supply chain resilience and aligns with the company's ambitions to increase its manufacturing footprint in the country. A high-visibility India win would be a reputational boost as Boeing continues to compete for global widebody and narrowbody orders.

Source: Simple Flying