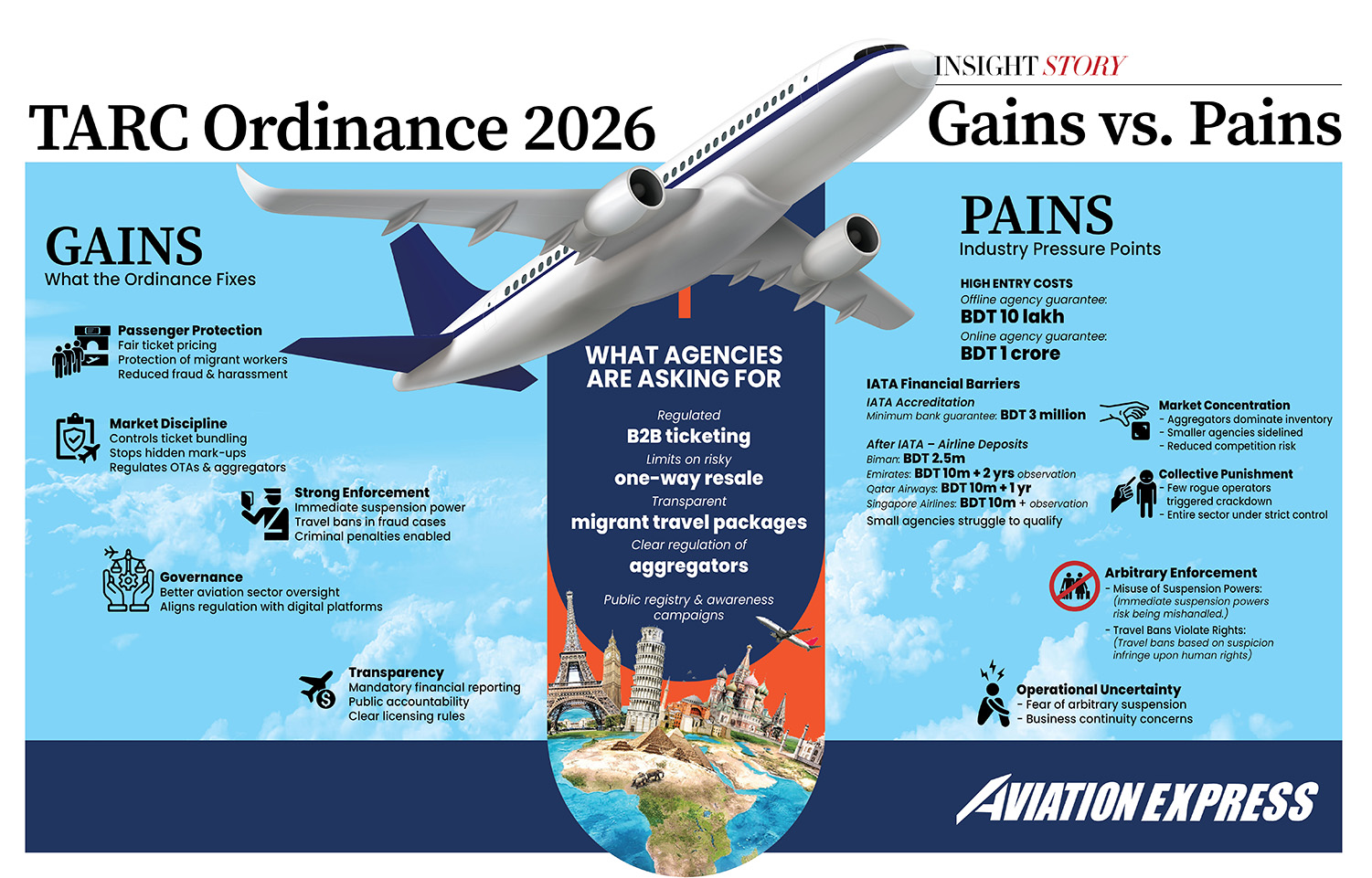

Insight Story

Agency Struggle: Who Pays the Price for Over-Regulation?

Reduced B2B liquidity risks higher prices for migrant workers despite promised subsidies or tax relief

Senior Reporter

| Published: Monday, February 02, 2026

Senior Reporter

| Published: Monday, February 02, 2026

Aviation Express Infographics

By Tarek Alif

In a sweeping bid to dismantle syndicates and protect migrant workers from airfare manipulation, the Bangladesh government has enacted the Travel Agency Registration and Control (TARC) Ordinance–2026. Presented by the Ministry of Civil Aviation and Tourism (MOCAT) as a long-overdue regulatory clean-up, the ordinance tightens oversight of travel agencies through stricter financial guarantees, limits on ticket resale, and expanded enforcement powers.

But within Bangladesh’s aviation and travel trade, the law has triggered deep unease. Industry leaders warn that while the ordinance targets malpractice, its broad restrictions risk choking competition, destabilising small and medium-sized agencies, and ultimately raising costs for migrant workers—the very group it aims to protect.

The roots of the reform lie in the turbulent months of July–August 2024, when allegations surfaced that air tickets to labour-heavy destinations such as the Middle East and Southeast Asia were being sold at four to five times their face value. Trade bodies approached the government with complaints of hoarding, artificial scarcity, and opaque pricing practices, particularly affecting outbound migrant workers.

In response, MOCAT zeroed in on the Business-to-Business (B2B) ticketing model, concluding that inter-agency resale of airline inventory was a key driver of price inflation. The TARC Ordinance consequently introduced sweeping restrictions on B2B transactions and one-way ticket resale—especially for agencies lacking International Air Transport Association (IATA) accreditation.

Critics argue, however, that the approach oversimplifies a complex ecosystem.

A Fragile Supply Chain

Bangladesh’s labour migration market relies heavily on recruitment and placement agencies that bundle visas, medical clearances and air tickets into a single package. Many of these agencies do not hold IATA accreditation and therefore depend on licensed consolidators or peer agencies to access airline inventory.

By sharply restricting B2B ticket transactions, industry insiders say the ordinance risks paralysing this supply chain rather than dismantling syndicates.

Former Association of Travel Agents of Bangladesh (ATAB) president Manzur Morshed Mahbub has been among the most vocal critics. He described the ordinance as a “black law” that threatens the survival of the industry, noting that the gazette was published on January 1, 2026.

Mahbub pointed specifically to clause (kha) of sub-section (umo) of Section 4, which prohibits the buying and selling of airline tickets between travel agencies.

“Out of nearly 5,800 registered travel agencies, only about 800 hold IATA membership,” he said. “The remaining nearly 5,000 agencies lack the capacity to issue tickets independently. If they cannot source tickets from others, they cannot serve passengers or meet the mandatory annual turnover of Tk 50 lakh required for licence renewal.”

Financial Barriers Rise

Concerns extend beyond B2B restrictions to the ordinance’s financial thresholds. Mohammad Jalal Uddin Tipu, convener of the ATAB Members’ Welfare Unity Alliance, criticised the requirement for offline agencies to submit bank guarantees of Tk 10 lakh, arguing that thousands of agencies already struggle to secure IATA accreditation due to capital constraints.

IATA accreditation itself requires a minimum bank guarantee of Tk 30 lakh, a clean six-month operational history, and compliance with stringent financial audits. Even after accreditation, agencies face additional airline-specific deposits.

Major carriers such as Biman Bangladesh Airlines, Emirates and Qatar Airways require deposits ranging from Tk 25 lakh to Tk 1 crore, depending on risk assessment and observation periods. Historically, smaller agencies navigated these hurdles by sourcing tickets through licensed peers—a practice now heavily restricted.

The cumulative effect, industry leaders say, is a sharp rise in entry barriers.

Tour Operators Sound Alarm

The Tour Operators Association of Bangladesh (TOAB) has echoed these concerns. TOAB President Md Rafeuzzaman described the ordinance as “not business-friendly” and warned of severe consequences for the travel and tourism sector.

“The requirement to submit a security deposit of Tk 10 lakh will make it extremely difficult for many operators to continue their businesses or even enter the market,” Rafeuzzaman said. “Small and medium-sized agencies will be the worst affected.”

He also criticised the decision to restrict B2B operations and limit ticket sales by non-IATA agencies, calling the measures unrealistic and disconnected from the operational realities of Bangladesh’s travel trade.

“These provisions will disrupt normal business flows and hinder the overall growth of the sector,” he said.

Impact on Migrant Workers

The most biting irony of the TARC Ordinance, critics argue, lies in its likely impact on migrant workers.

While the law promises transparency through invoice traceability, disclosures, and stricter oversight, reduced B2B liquidity often leads to higher end-user prices. As the pool of authorised sellers shrinks, competition diminishes.

“When the pool of authorised sellers shrinks, competition falls,” said an industry analyst. “Subsidies or tax exemptions do not automatically reach workers if fewer players are setting prices.”

Bangladesh’s remittance economy depends on cost-sensitive migrant workers, many of whom already face high migration expenses. Even marginal airfare increases can push workers toward informal channels or unsafe financing arrangements.

Lessons from OTA Failures

Industry insiders also point to lessons from past online travel agency (OTA) failures. Several collapses exposed weak oversight of large offline aggregators that extended unsecured credit to OTAs.

An OTA owner, speaking on condition of anonymity, argued that enforcement should focus more sharply on aggregators rather than smaller agencies.

“Aggregators should never have extended large unsecured credit in the first place,” he said. “They must be held accountable through proof-of-payment requirements, reporting of credit exposure, and higher guarantee thresholds.”

Such measures, he added, would strengthen oversight and allow MOCAT to regulate the fragmented market more effectively than blanket bans.

Due Process Concerns

Beyond economics, the ordinance has raised concerns about regulatory overreach. Provisions allowing suspension of agency registrations without prior hearings, the imposition of travel bans based on suspicion, and harsh penalties for discounting under vaguely defined rules have unsettled the industry.

Stakeholders warn that these measures create a hostile business climate, discouraging investment, deterring new entrants, and stifling innovation. Travel bans without due process also raise serious questions about fair business practices and rights protections.

A Call for Balance

As the aviation and travel industry adjusts to the new regime, a cautious consensus is emerging among stakeholders including ATAB, TOAB, airline GSAs and GDS operators: regulation is necessary, but proportionality is critical.

Rather than outright bans on B2B transactions, experts advocate digital traceability, tiered financial requirements, and differentiated compliance frameworks that allow smaller agencies to operate transparently without being pushed out of the market.

Without such calibration, the TARC Ordinance–2026 risks becoming a turning point in the wrong direction—transforming a diverse, competitive travel trade into a closed market and leaving migrant workers, the backbone of Bangladesh’s remittance-driven economy, to bear the unintended costs of over-regulation.